All-in-one institutional platform for digital asset investors

-

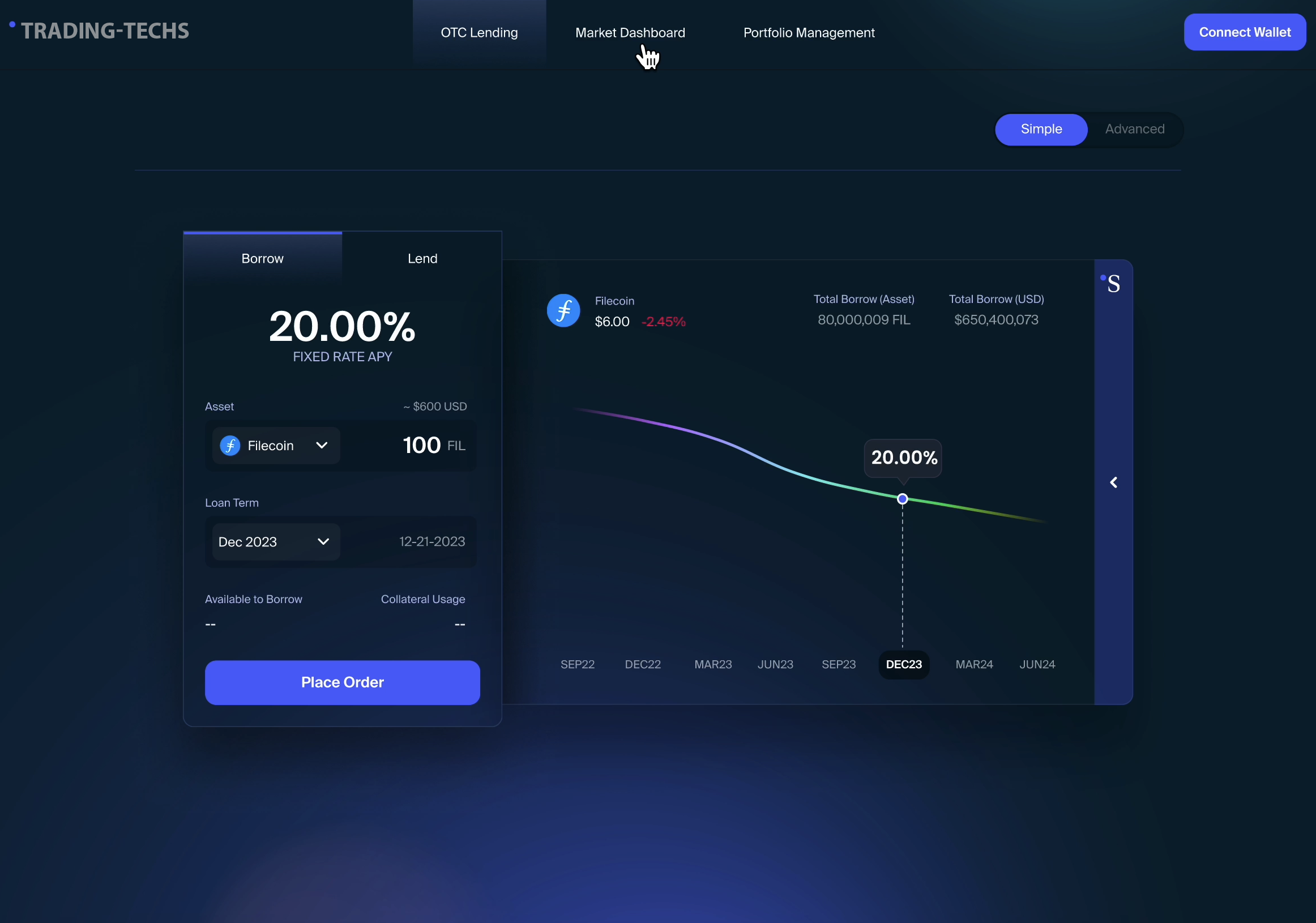

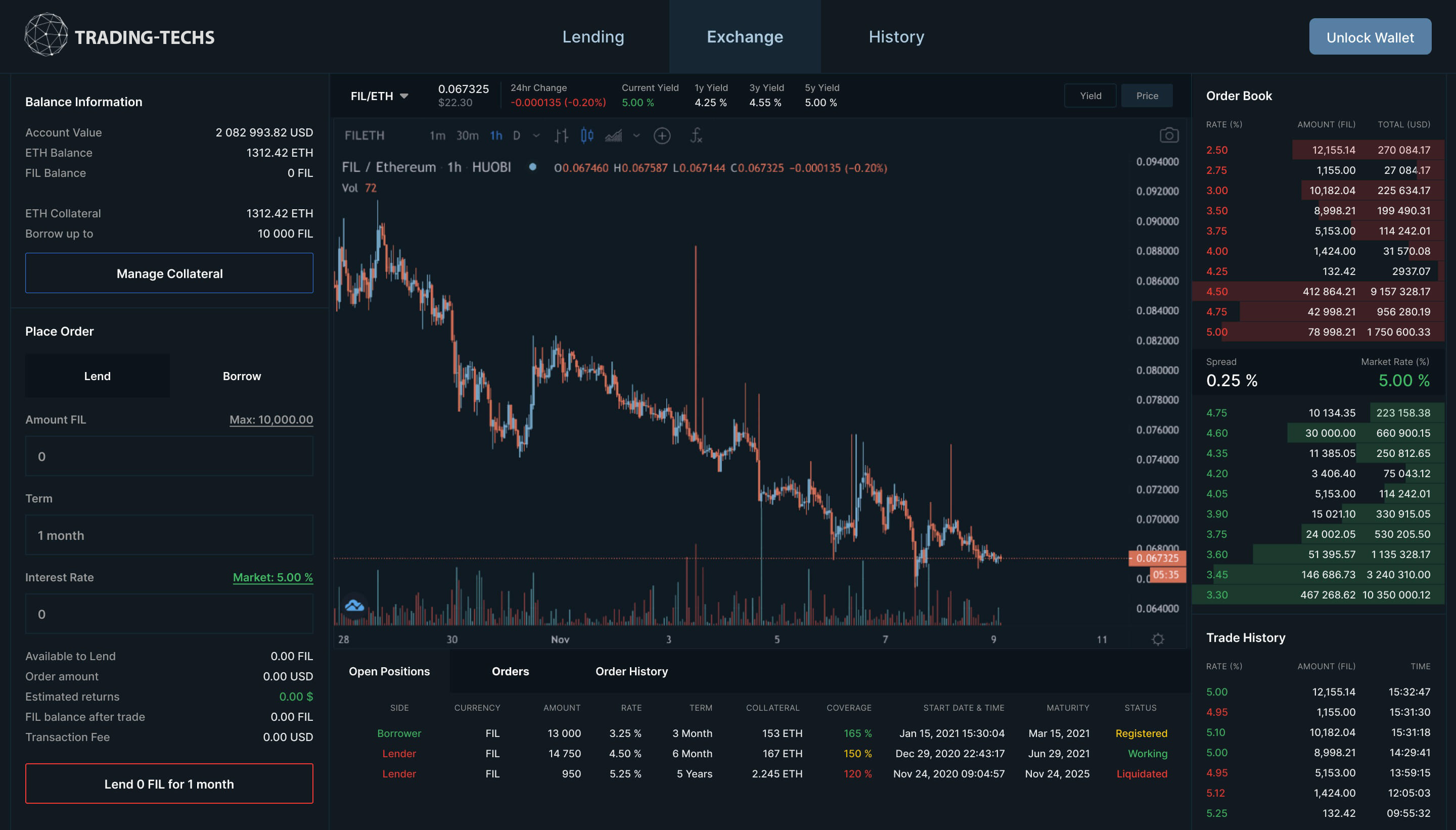

Collateralised P2P lending

Lend and borrow digital assets with higher interest rates returns for Filecoin, Ethereum, Bitcoin and USDC

-

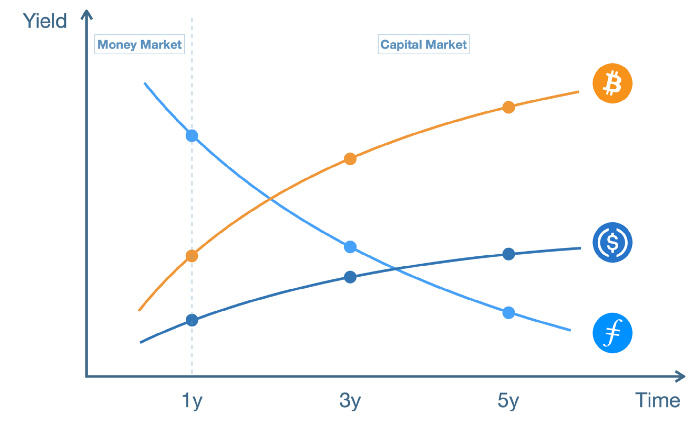

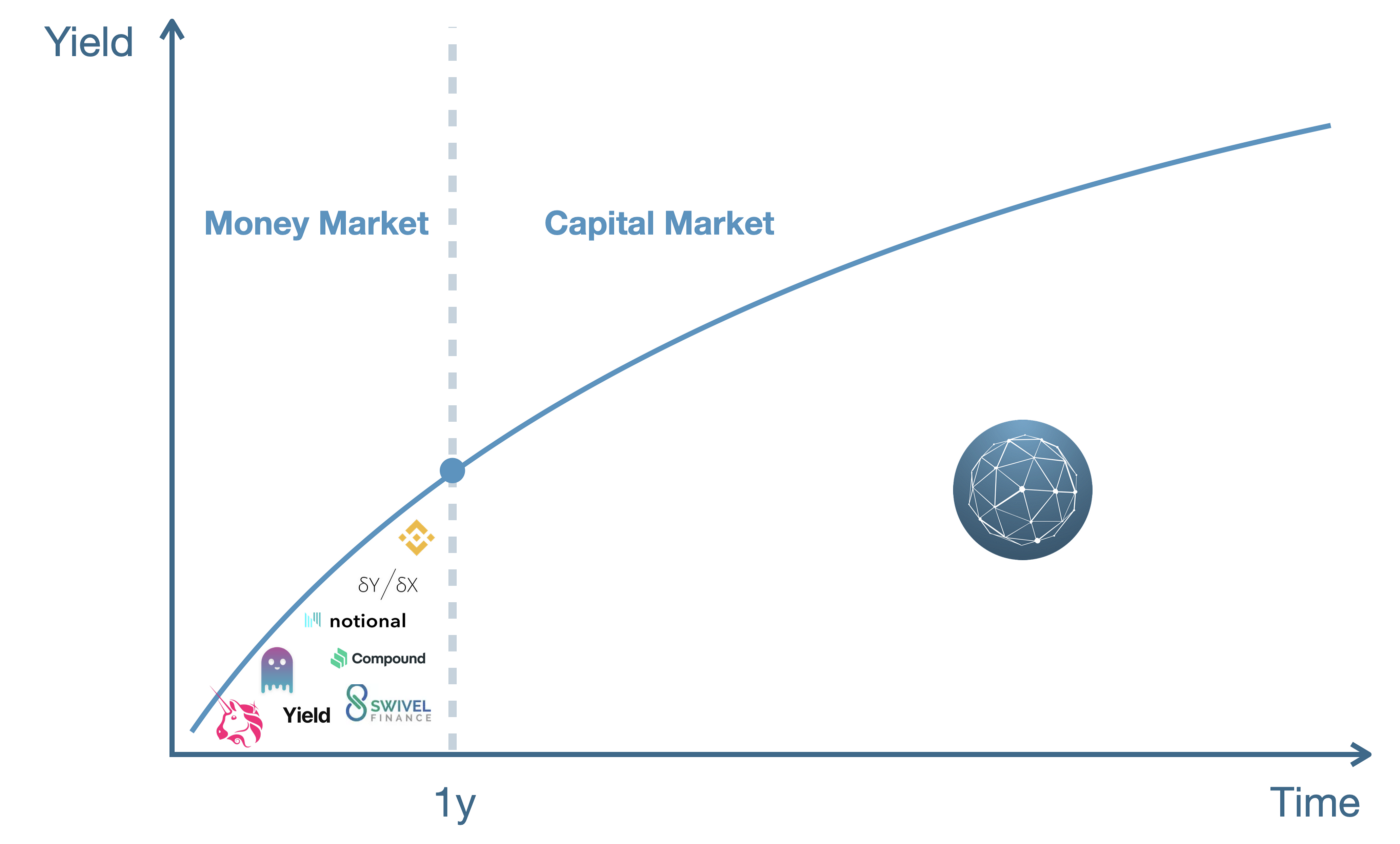

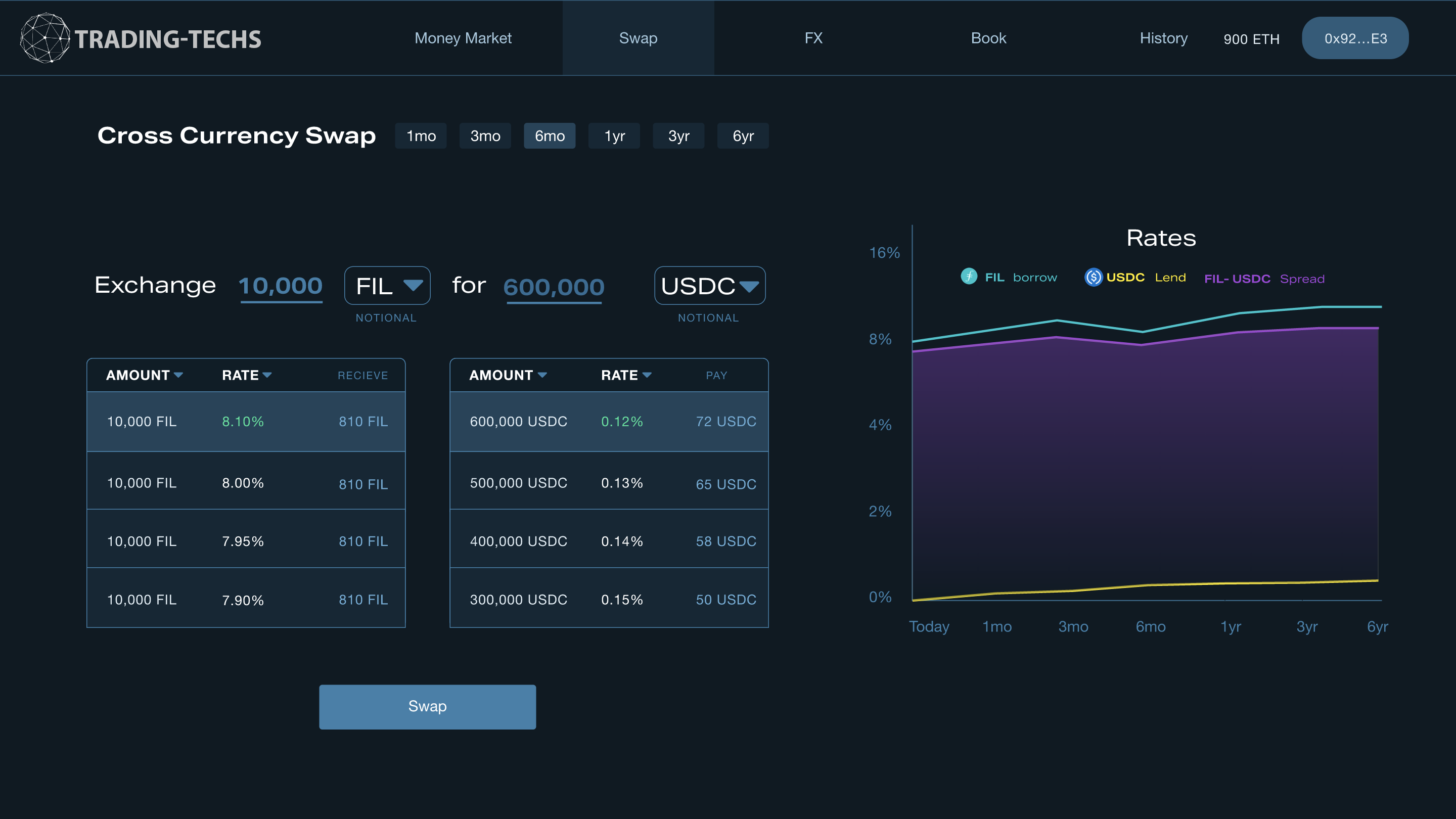

Cross-currency swaps

Diversify your portfolio using cross-currency swaps for up to 7% carry trade returns and hedge strategies compared to zero interest rates economy.

-

Cross-chain FX trading

Trade large volume with minimal slippage, trusted counterparties, and secure cross-chain settlement.